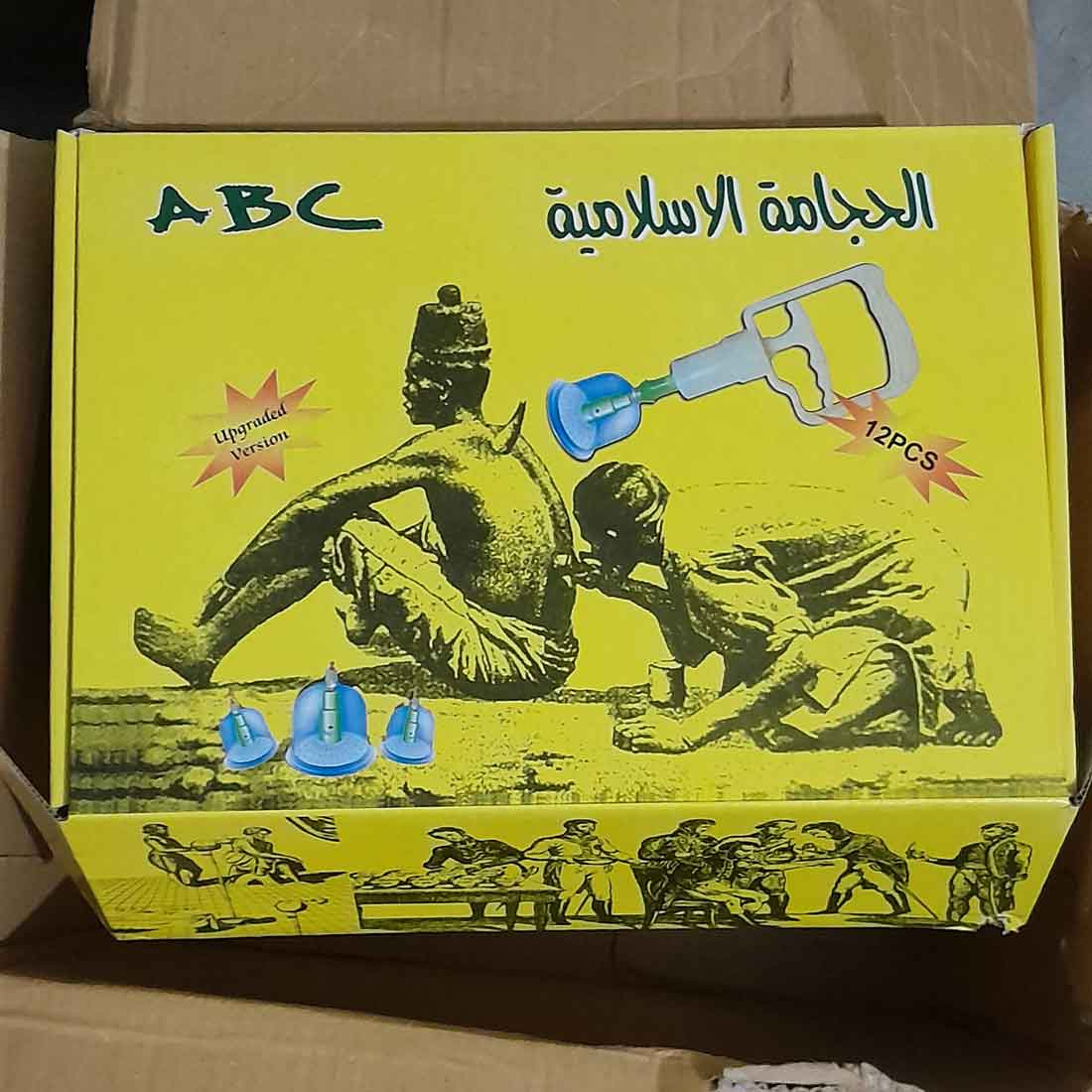

Hijama Cupping Therapy Sets

|

Hijama cupping therapy offers benefits similar to acupressure, a technique used in Traditional Chinese Medicine (TCM).....

Yoga classes for back injury

|

yoga can be beneficial, but it's crucial to choose the right poses and modifications to avoid aggravating your condition.....

Kashmiri Saffron

|

Saffron, known as "red gold," has several alternatives. Kesar and Zafran are regional names used in Indian and Spanish cuisine. Turmeric and paprika can substit....

Pakistani Cotton Salwar Kameez

|

The salwar kameez is thenational dress of Pakistani women. They are available in elegant designs and patterns. ....